The Secret to Singapore’s Casino Gambling Success

Posted: October 22, 2014

Updated: June 4, 2017

Singapore has a smaller gambling market than Macau or Las Vegas but it’s casinos see higher profit margins. Why? A diverse business model.

The global casino industry is usually thought of as a tale of two cities: Macau and Las Vegas. Vegas has the near-century of tradition and an army of casino executives with the expertise to spearhead profitable gambling projects worldwide, and Macau has the glitz, glamour and advantage of being located in the backyard of hundreds of millions of Asian gamblers.

But don’t forget Singapore, the tiny city state which doesn’t often make the gambling news but has an impressive casino industry of its own. Last year the country’s two resort casinos, the Resorts World Sentosa and Marina Bay Sands, earned a total of $6.1 billion in revenue, third-best in the world.

Also unique to the city is that Singapore gambling laws discourage locals from gambling. Residents of Singapore must pay $80 at the door before entering either of the two casinos, while holders of foreign passports are allowed entrance without restriction.

This stems from the government’s desire to profit from gambling while limiting what are perceived as harmful social effects. They would prefer casinos to be frequented primarily by tourists and temporary business travelers who will come, spend money, and leave.

Residents of the country would hardly notice that a casino industry existed, if not for all of the employment opportunities and tax revenue it provides.

However, Singapore’s casinos are more profitable in relative terms. Both the Marina Bay Sands and Resorts World Sentosa operate at higher marginal profits than the aggregate of Macau’s 30-plus casinos.

While serving fewer customers than the biggest Macau establishments like the Venetian Macau and Wynn Macau, these casinos are able to make more money from each customer.

Why? Operating costs are much lower, and the reason is that casino investors there have effectively built a diverse “integrated resort” model offering much more than table games and Singapore poker rooms.

These establishments invest higher proportions of their resources on-gambling amenities like restaurants, live shows (both concerts and theater performances), and MICE facilities (meetings, incentives, conventions and exhibitions).

These services don’t bring in million dollar wagers like what you’ll see in some Macau baccarat rooms, but their operating costs are much lower. For example, Macau casinos spend millions of dollars providing comps to keep their VIP customers happy and coming for return visits. The Marina Bay Sands and Resorts World Sentosa have to do this as well, but on a much smaller scale.

In 2013 Macau casinos earned 5% of their revenue from non-gambling activities, compared to 25% for Singapore. Macau’s most diversified casino, the Venetian, earned only 12% of its revenue from non-gambling services.

At the end of the day, the Macanese business model means spending a lot of money on loss-making activities just to keep cash flowing in. Singapore doesn’t need to do that, so a larger proportion of revenue goes directly into the pockets of executives and investors.

But it also offers a lot of what makes Vegas so great, non-gambling entertainment. Singaporean casinos host live shows that can compete with anything Broadway has to offer, and its nightclubs are on par with the hottest Hollywood spots.

As for service, it’s top-notch. The croupiers, bartenders and waitstaff are the picture of professionalism, and the food is to die for. Many without a slightest interest in gambling find themselves having a fantastic time at either of Singapore’s integrated resort casinos.

In the end, everyone gets what they want. Gamblers get the VIP experience, tourists and business travelers get to be wined, dined and entertained, and executives and investors get pockets stuffed with cash.

Singapore doesn’t pull in the volume of Macau or Las Vegas, but it proves that in the casino business, bigger isn’t always better.

The global casino industry is usually thought of as a tale of two cities: Macau and Las Vegas. Vegas has the near-century of tradition and an army of casino executives with the expertise to spearhead profitable gambling projects worldwide, and Macau has the glitz, glamour and advantage of being located in the backyard of hundreds of millions of Asian gamblers.

But don’t forget Singapore, the tiny city state which doesn’t often make the gambling news but has an impressive casino industry of its own. Last year the country’s two resort casinos, the Resorts World Sentosa and Marina Bay Sands, earned a total of $6.1 billion in revenue, third-best in the world.

Singapore’s unique casino market

The casino industry in Singapore is undeniably successful, and it has made its mark doing things a lot differently from Macau and Vegas. While Macau’s casino market has grown at a torrid pace and Vegas takes an “all aboard” approach to attracting customers, things are done on a smaller scale in Singapore.• Singapore’s two casinos earned $6.1 billion in revenue in 2013For starters, the country has only two casinos, and the government is adamant that it will not issue any additional licenses. Both public officials and investors (most notably Sheldon Adelson of Sands and Tan Sri Lim Kok Thay of Genting) would rather the industry be small and extremely profitable than risk market saturation.

• Marina Bay Sands and Resorts World Sentosa see higher marginal profits than Macau casinos

• Singapore’s casinos are known for excellent non-gambling entertainment

Also unique to the city is that Singapore gambling laws discourage locals from gambling. Residents of Singapore must pay $80 at the door before entering either of the two casinos, while holders of foreign passports are allowed entrance without restriction.

This stems from the government’s desire to profit from gambling while limiting what are perceived as harmful social effects. They would prefer casinos to be frequented primarily by tourists and temporary business travelers who will come, spend money, and leave.

Residents of the country would hardly notice that a casino industry existed, if not for all of the employment opportunities and tax revenue it provides.

More profitable than Macau?

With only two casinos, Singapore’s market will never come close to matching the revenue earned by Macau, which saw a turnover of $45.2 billion in 2013. Macau has more casinos and is in closer proximity to the Chinese mainland, and will continue to lead the world in volume of gambling services provided.However, Singapore’s casinos are more profitable in relative terms. Both the Marina Bay Sands and Resorts World Sentosa operate at higher marginal profits than the aggregate of Macau’s 30-plus casinos.

While serving fewer customers than the biggest Macau establishments like the Venetian Macau and Wynn Macau, these casinos are able to make more money from each customer.

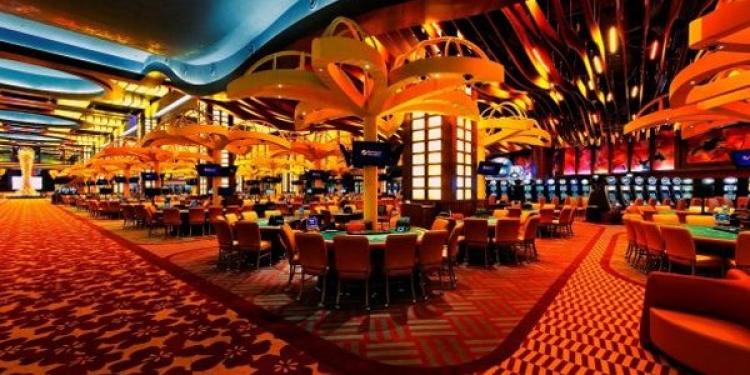

Why? Operating costs are much lower, and the reason is that casino investors there have effectively built a diverse “integrated resort” model offering much more than table games and Singapore poker rooms.

These establishments invest higher proportions of their resources on-gambling amenities like restaurants, live shows (both concerts and theater performances), and MICE facilities (meetings, incentives, conventions and exhibitions).

These services don’t bring in million dollar wagers like what you’ll see in some Macau baccarat rooms, but their operating costs are much lower. For example, Macau casinos spend millions of dollars providing comps to keep their VIP customers happy and coming for return visits. The Marina Bay Sands and Resorts World Sentosa have to do this as well, but on a much smaller scale.

In 2013 Macau casinos earned 5% of their revenue from non-gambling activities, compared to 25% for Singapore. Macau’s most diversified casino, the Venetian, earned only 12% of its revenue from non-gambling services.

At the end of the day, the Macanese business model means spending a lot of money on loss-making activities just to keep cash flowing in. Singapore doesn’t need to do that, so a larger proportion of revenue goes directly into the pockets of executives and investors.

Singapore is the best of worlds

Increasing numbers of gamblers love Singapore because it offers the best of Macau and Vegas. The casinos are massive and fabulously luxurious, offering every table game, poker variation and electronic gaming machine imaginable. Everything is done to a standard of style not seen in the Western hemisphere.But it also offers a lot of what makes Vegas so great, non-gambling entertainment. Singaporean casinos host live shows that can compete with anything Broadway has to offer, and its nightclubs are on par with the hottest Hollywood spots.

As for service, it’s top-notch. The croupiers, bartenders and waitstaff are the picture of professionalism, and the food is to die for. Many without a slightest interest in gambling find themselves having a fantastic time at either of Singapore’s integrated resort casinos.

In the end, everyone gets what they want. Gamblers get the VIP experience, tourists and business travelers get to be wined, dined and entertained, and executives and investors get pockets stuffed with cash.

Singapore doesn’t pull in the volume of Macau or Las Vegas, but it proves that in the casino business, bigger isn’t always better.

Related content

Subscribe

0 Comments